does massachusetts have an estate or inheritance tax

It also does not have a gift tax. Massachusetts has an estate.

Massachusetts Estate Tax Law Needs Overhaul Editorial Masslive Com

Is inheritance taxable in Massachusetts.

. If the estate is worth less than 1000000 you dont need to file a return or. Massachusetts does not have an inheritance tax. Fortunately Massachusetts does not levy an inheritance tax.

Massachusetts has an estate tax but not an inheritance tax. In 2020 there is an. Massachusetts has no inheritance tax.

Connecticuts estate tax will have a flat rate of 12 percent by 2023. Inheritance tax is a state tax paid by a beneficiary on the value of what they received as an inheritance. Massachusetts and Oregon have.

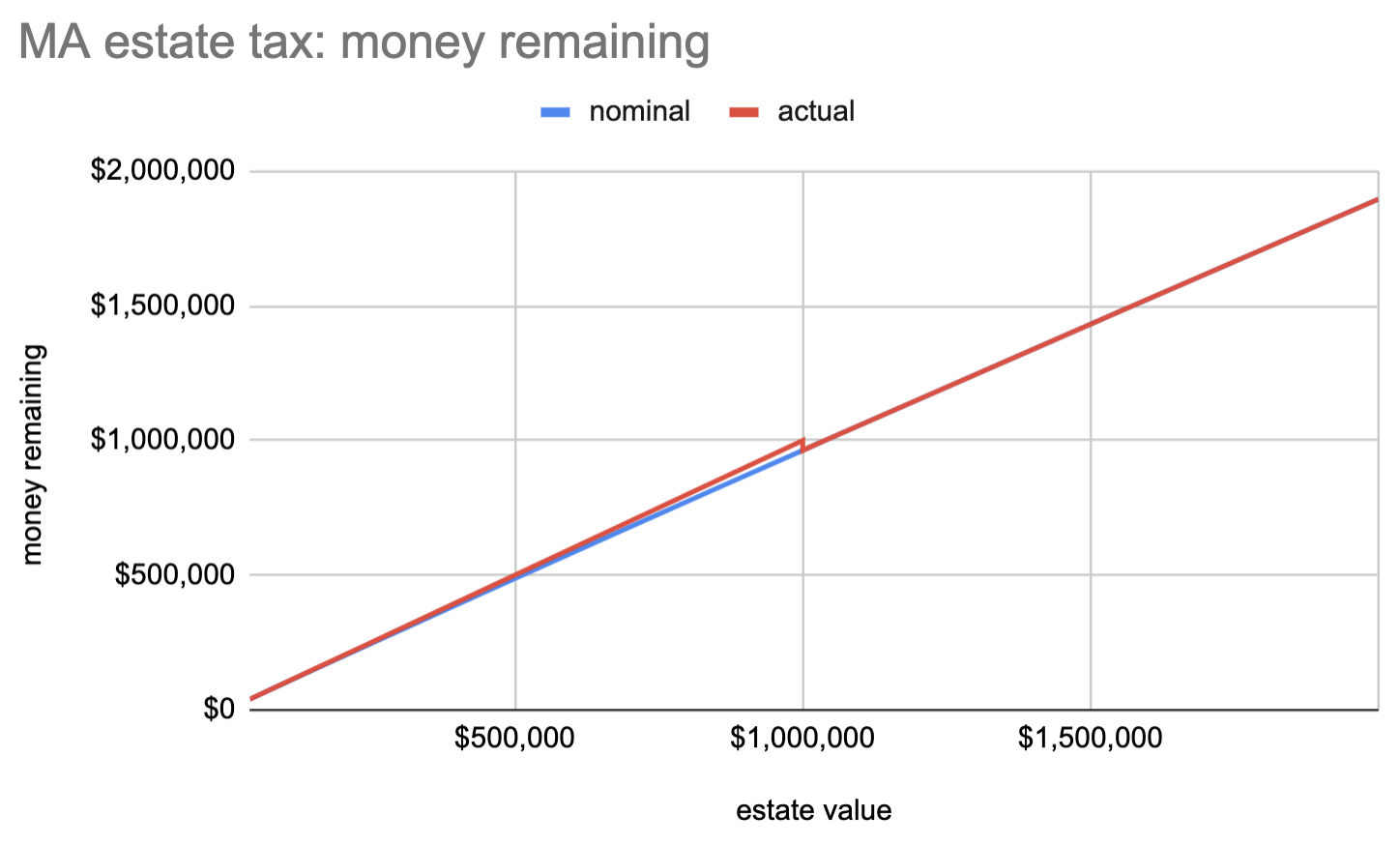

Therefore a Massachusetts estate tax return is required because the sum of the decedents gross estate at death and the adjusted taxable lifetime gifts exceeds 1000000. When you die if your estate is valued at 1M or under you pay no estate tax. Fortunately Massachusetts does not levy an inheritance tax.

Inheritance tax is a state tax paid by a beneficiary on the value of what they received as an inheritance. But if you inherit money or assets from someone who lived in another state make. Massachusetts has an estate tax.

If you are feeling motivated here is the Massachusetts Department of Revenue Guide to the estate tax. While many people confuse inheritance taxes and estate taxes theyre actually two slightly different things. Iowa is phasing out its inheritance tax by reducing its rates by an additional 20 percent each year from the.

An estate tax is not the same as an inheritance tax. What is the most you can inherit without paying taxes. The Massachusetts estate tax exemption is 1M.

Inheritance Tax Here S Who Pays And In Which States Bankrate

What Is The Estate Tax In Massachusetts Massachusetts Probate Law Mcnamara Yates P C

Death And Taxes Nebraska S Inheritance Tax

Inheritance Tax And Your Massachusetts Estate Plan Slnlaw

How Much Is Inheritance Tax Community Tax

How Can I Avoid The Massachusetts Estate Tax Heritage Law Center

State By State Estate And Inheritance Tax Rates Everplans

How Much Is Inheritance Tax Community Tax

Introducing A Ma Bill Which Would Raise The Estate Tax Exemption

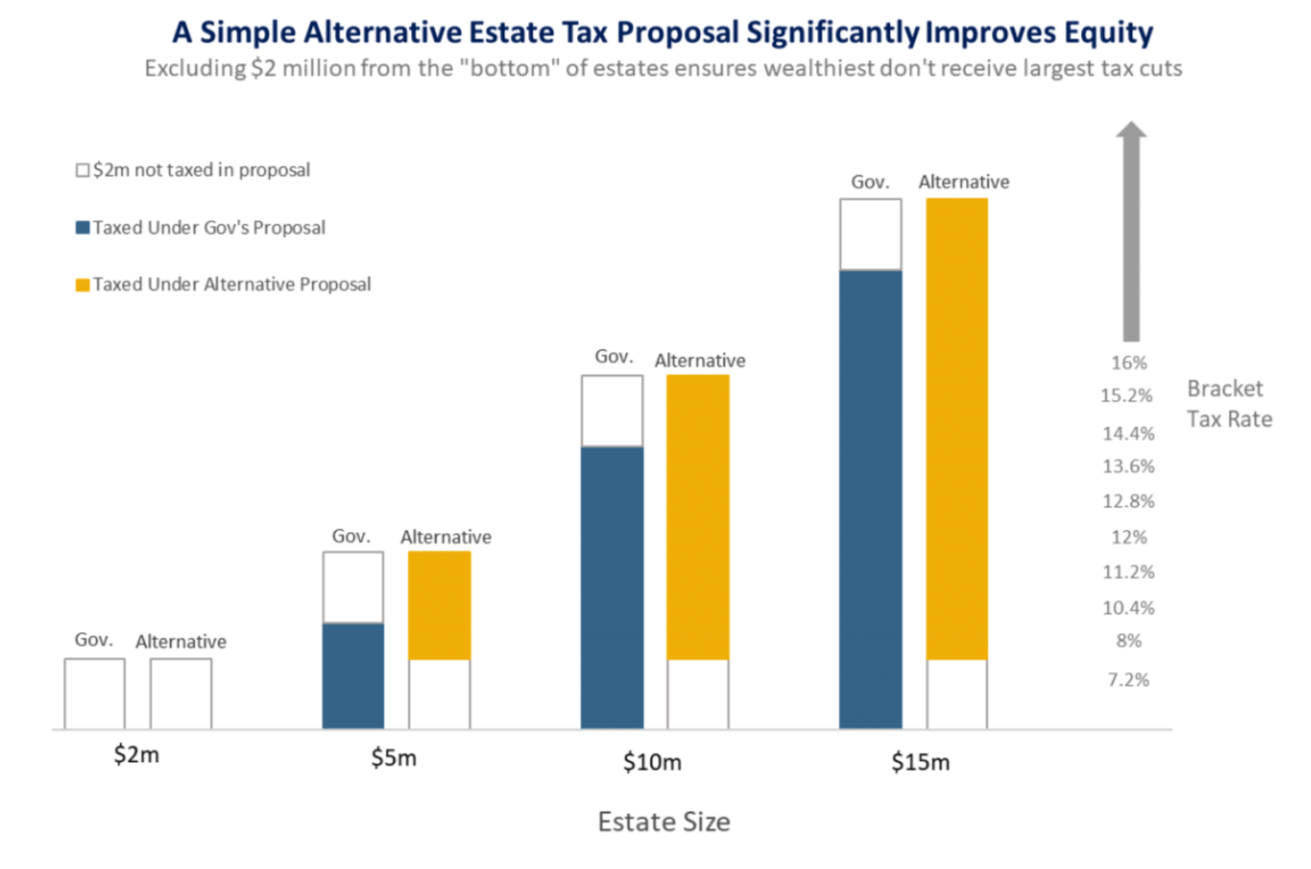

Current Estate Tax Proposals Would Give Largest Benefits To Wealthiest Estates Alternative Method Would Fix This Problem Mass Budget And Policy Center

What Is An Estate Tax Napkin Finance

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Massachusetts Inheritance Laws What You Should Know Smartasset

State By State Comparison Where Should You Retire

Does Your State Have An Estate Or Inheritance Tax Tax Foundation

A Guide To Estate Taxes Mass Gov